check income tax number

Check your Simple Assessment tax bill. Be sure to include your complete Social Security number and tax year on the check or money order.

Will Your Stimulus Check Increase Your Tax On Social Security Benefits Kiplinger

For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets.

. In addition to amounts you receive as normal rent payments there are other amounts that may be rental income and must be reported on your tax return. A Power of Attorney may be required for some Tax Audit Notice Services. Those payments can be made using the Michigan Individual Income Tax e-Payments system.

A separate agreement is required for all Tax Audit Notice Services. Fill in send and view a personal tax return. See if your tax code has changed.

Tax year of the refund. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate. Social Security number of taxpayer.

Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own. Comparison based on paper check mailed from the IRS. Claim a tax refund.

Exact amount of the refund. By law businesses and individuals must file an income tax. Check Your Federal Tax Refund Status If you have filed your federal income taxes and expect to receive a refund you can track its status.

You can check if you can claim a tax refund on GOVUK. You can also submit any late or partial payments by check or money order to Michigan Department of Treasury Lansing MI 48929. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence.

And you want to check your unpaid balance before you pay. Check whether you need to report and pay any tax on income you make apart from your main. And of course Washington DC.

By telephone at 317-232-2240 Option 3 to access the automated refund line. You must report rental income for all your properties. Have your Social Security number filing status and the exact whole dollar amount of your refund ready.

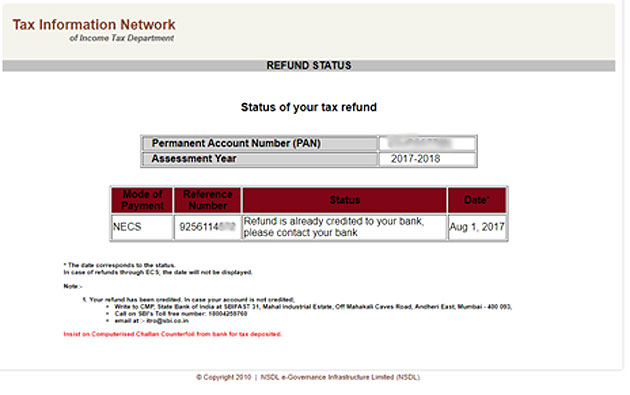

However you can use the income tax calculator to understand your tax liability and then check your TDS amounts to understand if you should claim a refund or pay any difference. Income Tax is a tax. Income Tax Return status online using your PAN and Acknowledgment number allocated by the Income Tax Department after filing your Income Tax Return.

To claim a refund of Vermont withholding or estimated tax payments you must file a Form IN-111 Vermont Income Tax Return. It will ask questions about how you pay any tax that may be due on income you earn from your licensed trade. If you have questions about how the health reform law will affect you and your insurance options please go to HealthCaregov or contact their Help Center at 1-800-318-2596 if you have questions.

An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. To check the status of your personal income tax refund youll need the following information. Amended tax returns not included in flat fees.

Find out about what it is how you pay and how to check youre paying the. Claiming benefits or government grants. Check your income from work in the previous 5 years.

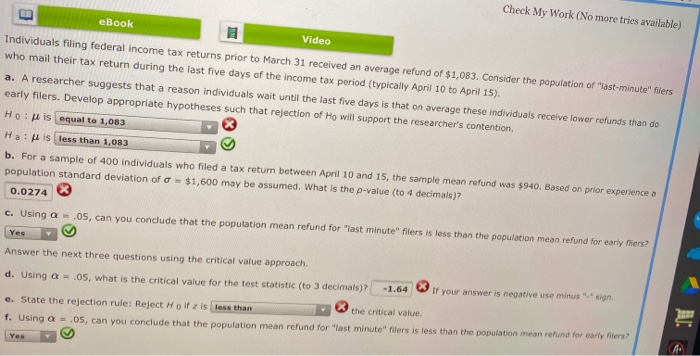

Your tax refund comes from your 2021 return and the IRS is required to start paying interest on overpayment 45 days after accepting a tax return. You have up to three years from the due date of the return including extensions to file a claim for overpayment of tax due. Your Social Security number SSN or Individual Taxpayer Identification Number ITIN Refund amount.

Check if you need to tell HMRC about additional. This service covers the current tax year 6 April 2022 to 5 April 2023. This page is for Income Tax payments.

Dont include personal or financial information like your National Insurance number or. To use the prompt you must have your. Consult your own attorney for legal advice.

8 Reasons Your Tax Refund Might Be Delayed. Tax Audit Notice Services include tax advice only. You might be able to increase your income by doing things like.

Rental income is any payment you receive for the use or occupation of property. Is not a state but it has its own income tax rate. Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a payment or check the status of your refund.

A tax check confirms that youre registered for tax if necessary. Registered charity number 279057 VAT number 726 0202 76 Company limited by. Check your tax code and Personal Allowance.

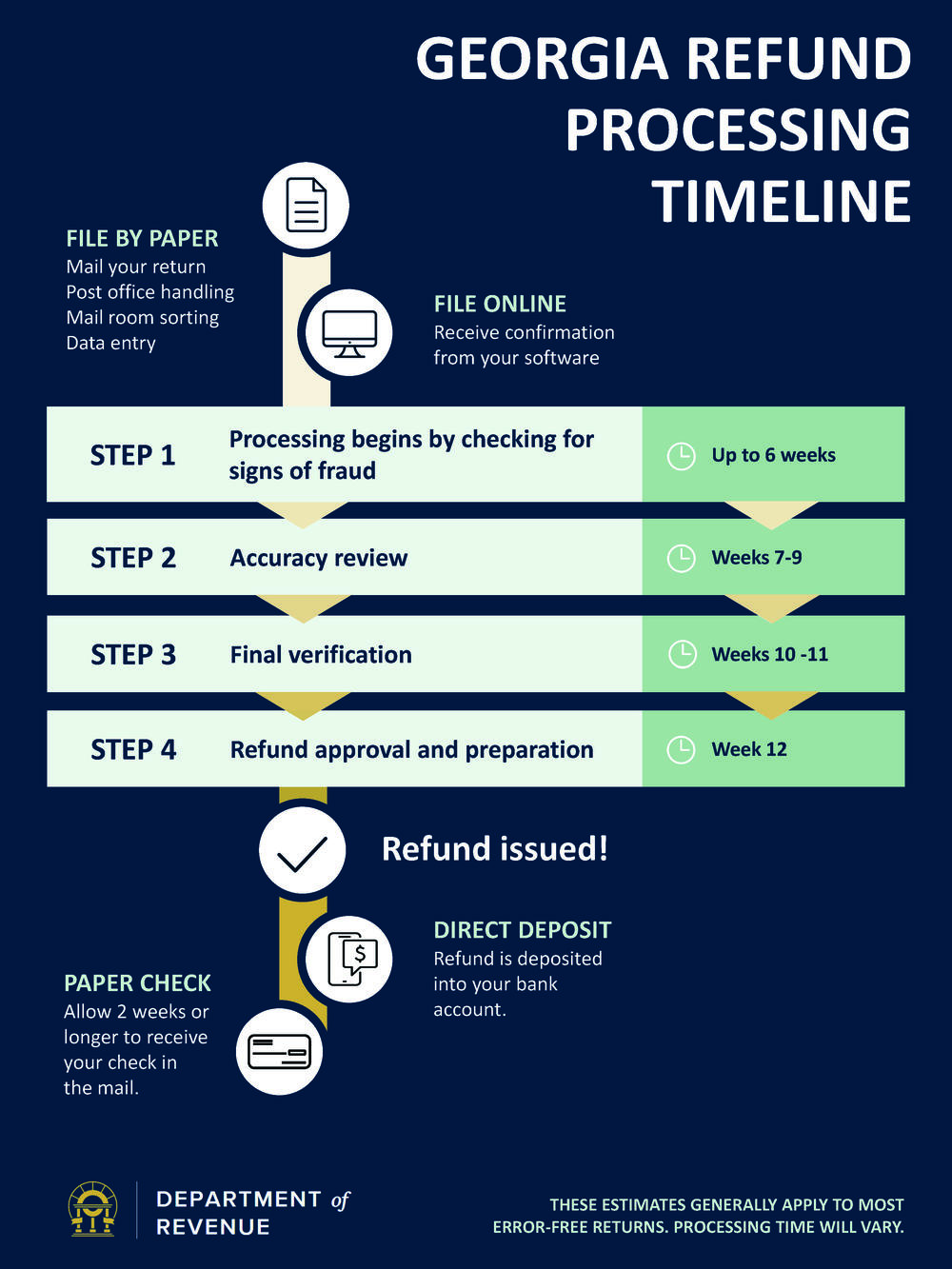

Check how much Income Tax you paid last year. More specifically it depends on your. Please allow 2-3 weeks of processing time before calling.

How to Check the Status of Your Refund What youll need. Dont include personal or financial information like your National Insurance number or credit card. Check your ITR Status ie.

Calculate Income Tax Online for FY 2022 - 23 and AY 2023 - 24 with Income Tax Calculator by HDFC Life. You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Two ways to check the status of a refund.

If you are a married or civil union couple and filing a joint income tax return enter the Social Security number listed first on your NJ-1040-ES payment voucher or on last years income tax return. Election to use prior-year earned income. Check your Income Tax estimate and tax code.

The size of your payment if you qualify will be somewhere between 200 and 1050 depending on your tax filing status the number of dependents and income. Use the service to. You must carry out.

Check your Income Tax for the current year.

Here S What To Know About Filing For An Extension On Your Tax Returns Abc News

Income Tax Refund Status How To Check Income Tax Refund Status

How Do I Check My Income Tax Return Status

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Where S My Refund Georgia Department Of Revenue

How To Answer The Virtual Currency Question On Your Tax Return

Solved Check My Work No More Tries Available Ebook Video Chegg Com

How To Check Active Taxpayer List Income Tax Fbr Youtube

How To Calculate Earned Income For The Lookback Rule Get It Back

Will I Pay Taxes On Stimulus Check Money Wusa9 Com

3 21 3 Individual Income Tax Returns Internal Revenue Service

Rita Income Tax Filers Can Claim A Refund For Working At Home During Coronavirus But Might Not Get The Money Cleveland Com

How To Get Your Maximum Tax Refund Credit Com

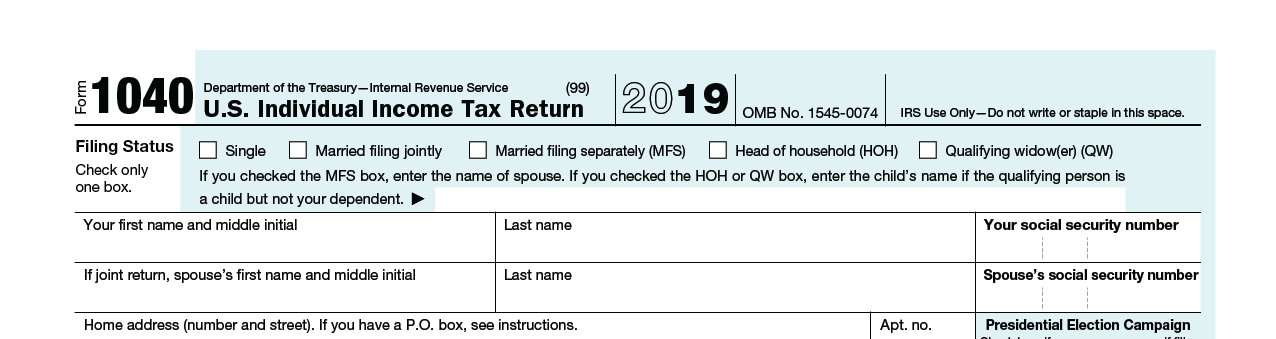

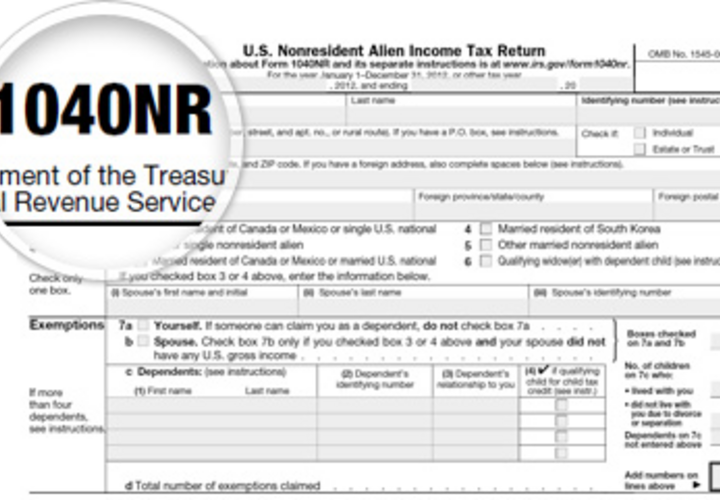

U S Taxes Office Of International Students Scholars

.png)

How To Check Your Income Tax Number

![]()

Income Tax Refund Tracker How To Check Refund Status Using 2 Irs Online Tools Itech Post

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Comments

Post a Comment